do pastors file taxes

Clergy can request that an additional amount of income tax. Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns.

The Pastor S Tax Man Clergy And Minister Taxes Simplified

They are considered a common law employee of the church so although they do receive.

. What form does a pastors income get filed under. Since 1943 Murdock v. Ad Fast Friendly Jovial Professional File Tax Return Today Affordable Tax Preparation Fees.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Regardless of the employment status of a pastor Social Security and Medicare cover services performed by that pastor under the self-employment tax system. The church is not required to report the housing allowance to the IRS.

Pastors fall under the clergy rules. This means a church normally wont withhold. Get Your Max Refund Today.

Generally there are no income. Ministers are not exempt from paying federal income taxes. Pastors are exempt from income tax withholding and are not obligated to have federal taxes withheld from their paychecks.

Fast And Simple Tax Filing. Get Your Taxes Done Right Anytime From Anywhere. Members of the clergy and other religious workers should file Form 1040 Schedule SE and review Publication 517 to pay social security and Medicare taxes.

Get A 2nd Opinion. Ad File Your IRS Tax Return for Free. While they can be considered an employee of a church for federal income tax purposes a pastor is considered self-employed by the IRS.

For tax purposes a minister is a person who is a duly ordained commissioned or licensed minister of a church This includes Rabbis and other ordained clergy. 105 the United States Supreme Court has ruled that the First. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

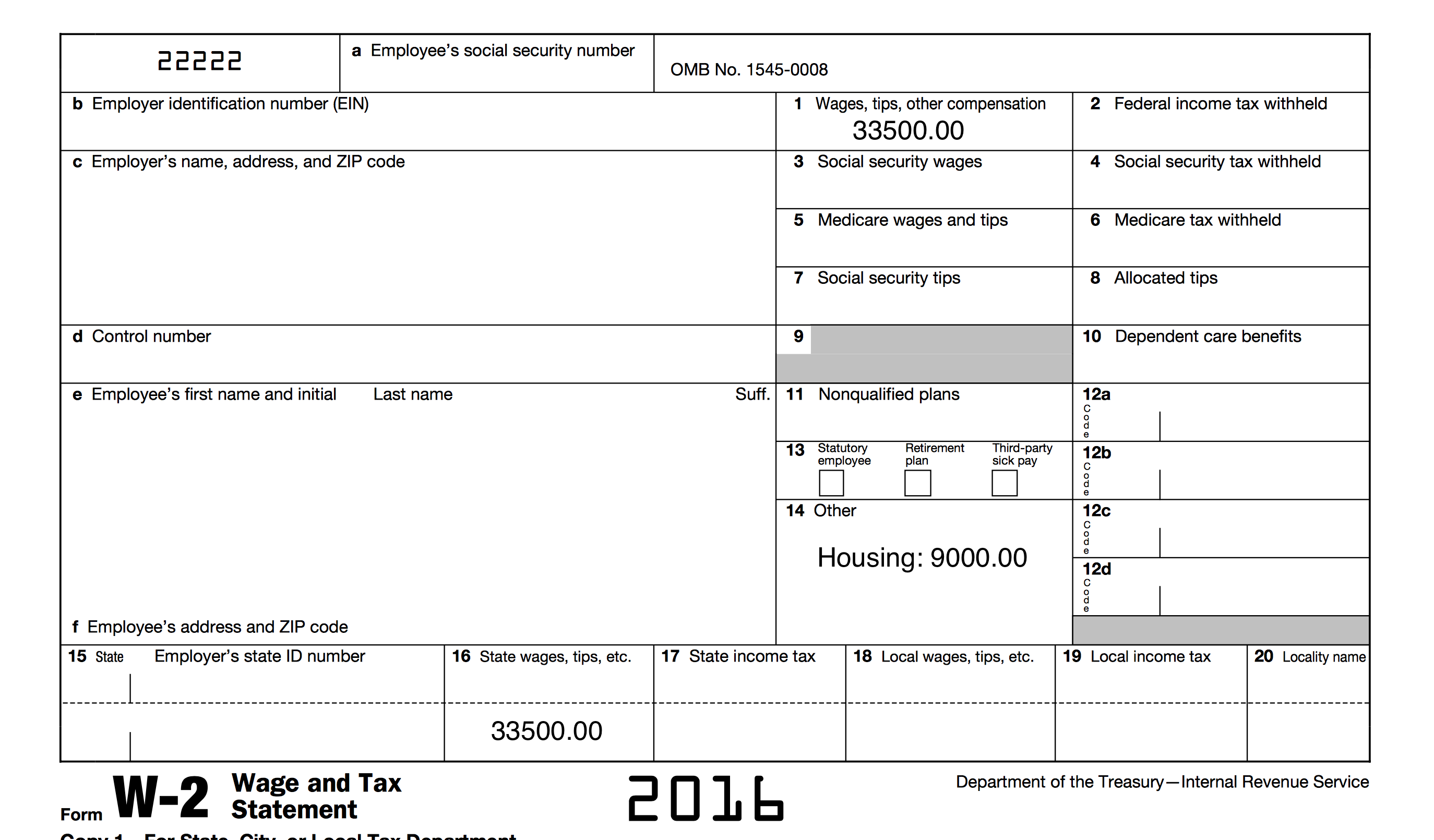

Even though a minister pays the self-employment tax they are not eligible to file a Schedule C to deduct business expenses related to their wages from the church. Ad Free tax support and direct deposit. If you are a member of the clergy you should receive a Form W-2 Wage and Tax Statement from your employer reporting your salary and any housing allowance.

Minimize Reduce Inc Taxes. Ministers have a unique. TurboTax CDDownload Products.

Get Your Max Refund Today. Pastors may voluntarily choose to ask their. You must file it by the due date of your income tax return including extensions for the second tax year in which you have net earnings from self-employment of at least 400.

Clergy must pay quarterly estimated taxes or request that their employer voluntarily withhold income taxes. A pastor has a unique dual tax status. Additional fees apply for.

Get Your Taxes Done Right Anytime From Anywhere. But clergy are both exempt from federal income tax withholding and considered self-employed for Social Security tax purposes. This is an excerpt from my book The Pastors Wallet Complete Guide to the Clergy Housing Allowance.

Fast And Simple Tax Filing.

Irs How To Handle Senior Pastor Tax Return Seniorcare2share

Pin On Trying To Make Taxes Not Boring

2022 Church Clergy Tax Guide Clergy Financial Resources

Pin On Girl Boss Tips Tricks For Saving On The Job

If They Re So Interested In Getting Into Politics And Telling Us How To Live Our Lives Let Them Pay Taxes Like The Rest Of Us Fix It Jesus Pastor Paying Taxes

Does Tax Exempt Religious Status Extend To Clergy Are Pastors Priests Ministers And Reverends Required To Pay Tax On Their Salary Quora

Nts Faq Reporting Pastor S Income On Forms W 2 And 941

Dual Tax Status What Does It Mean For Your Pastor American Church Group Tennessee

How To Determine If A Pastor Is An Employee Or Self Employed For Federal Tax Purposes The Pastor S Wallet

Tax Preparation For Pastors And Clergy Tax Preparation Our Services

2022 Church Clergy Tax Guide Clergy Financial Resources

How Pastors Pay Federal Taxes The Pastor S Wallet

What Taxes Can Churches Withhold For Pastors The Pastor S Wallet